Know the Lingo

5/2/2017 (Permalink)

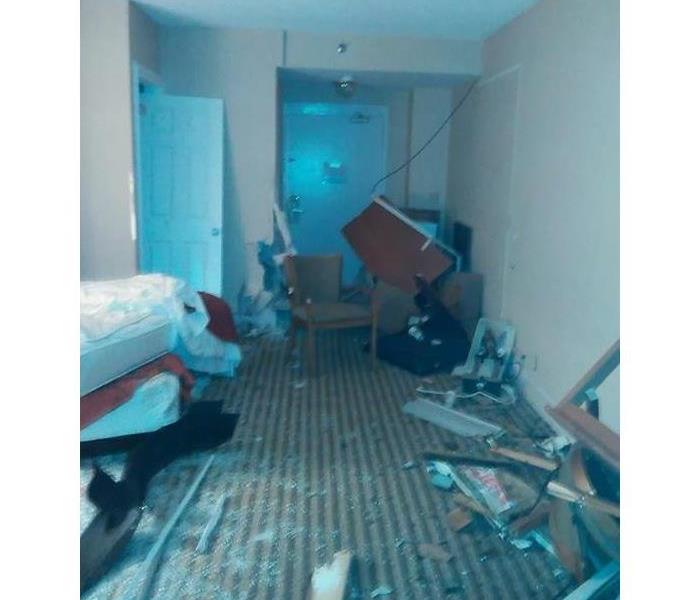

When vandalism happens to your home or business SERVPRO can make the aftermath, "Like it never even happened."

When vandalism happens to your home or business SERVPRO can make the aftermath, "Like it never even happened."

What is lingo?

It is the language used by a certain group to communicate commonly used word or words to describe a situation. If you are out of the loop with the slang used by a group then it is nearly impossible for you to understand the conversation taking place. The same can be said for homeowners discussing their insurance policies with a carrier, agent or adjuster. Sometimes our job includes being the bridge between the customer and the insurance adjuster. With so many restoration companies to pick from why choose us? It's simple, we are here to help you!

Recently, we were called out to property in East Falmouth that had been broken into while the family was away. The homeowners had called their insurance carrier and the local authorities to report the break in and damage done. Once the police were finished with processing the crime scene and the insurance adjuster had determined the cost of the damage it was our turn to restore the property. Some of the damage included the finger printing powder used by the officers to investigate the crime scene along with the evidence of broken glass, the blood associated with the broken glass and the fire extinguisher residue that was sprayed by the criminals throughout the premises. But the mess did not end there. It was apparent that the party had made its way into the backyard where more damage was done to a fence and shed. In an instance like this one there were so many parties involved in this claim that the property owner felt overwhelmed. We helped them with the process and though the trauma of the vandalism will never go away completely our team helped to make the damage, “Like it never even happened.”

To better help property owners with these types of situations below is a cheat sheet to help with the lingo needed to reclaim your life after a property damage. We hope that by defining the following "lingo” when dealing with a property damage there is a sense of knowledge and we all know that knowledge is power.

- Dwelling protection. This coverage typically covers your home and attached structures, like a deck or garage. The key word here is “attached.” I shed or fence may not be covered under a dwelling policy.

- Personal property protection. From furniture to electronics, this coverage may help pay to replace belongings that are stolen or damaged by a covered loss. You are going to want to make sure you have a list of these items along with appraisals of their value.

- Other structures protection. This coverage may help pay to repair or replace structures on your property that aren't attached to your home, like a fence, detached garage or shed, if they are damaged by a covered peril. Note: as mentioned above this is not considered dwelling protection.

- Family liability protection. Accidents can happen. Liability coverage may help protect you if someone is injured on your property and you are found legally responsible for damages. Just because someone is family doesn’t mean you aren’t at risk of being sued.

- Guest medical protection. If a visitor is injured at your home, this coverage may help pay for their resulting medical expenses. This coverage is a must if you’re the family that is planning the big party after graduation to celebration.

- Additional living expenses. This coverage may help you pay for temporary increased living costs, such as hotel bills, if you are unable to stay in your home after a fire or other covered loss. We often get asked about this coverage. It’s important to know you have the right to housing if you are unable to stay at your property due to harmful conditions.

- Deductible. This is basically the amount “deducted” from an insured loss and represent a sharing of the risk between the insurance company and the policyholder. What is my deductible is by far our #1 question from insurers. Look for more information about deductibles with our next blog posting, Know Your Deductible.

24/7 Emergency Service

24/7 Emergency Service